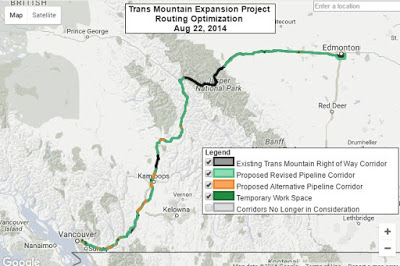

Recently, the Canadian federal government approved a pipeline expansion project that adds a second pipeline along an existing route from Edmonton, AB to Burnaby, BC. Here’s the map:

The pipeline has its own marketing site, touting the benefits:

Helping us “keep up with the rising global demand for oil” and “increased tax benefits for all of Canada” sounds great, right?

Except that it’s misleading. While technically true that demand is rising:

- Demand is increasing much slower than previously projected

- Supply is increasing as fast or faster than demand

And when supply increases faster than demand, prices fall.

Most projections, including this recent one from oil-price.net, predict that oil prices will stagnate or even decrease over the next few years.

It’s also important to note that Alberta oil sells at a significant discount to the “regular” oil price you hear quoted in the news. For instance, when WTI crude fell to $30, Canadian oil was selling at $8/barrel.

Depending on who you ask, the “break-even” WTI price for the average Alberta oil project is somewhere between $50-$75, but there’s a wide variance, and much disagreement on how the price is calculated.

Besides that – Did you know that $3.3 billion of your hard-earned tax money is simply handed over to the oil and gas industry each year?

Oil executives talk about leaving things to the “free market” while pocketing piles of taxpayer’s money.

How many of these projects would continue to be viable if the government trough dried up?

There is a huge glut of easily accessible, cheap oil on the world market right now. That’s why prices have remained so low.

These prices will likely recover in the long term, but meanwhile, let’s be sensible, and leave our oil in the ground for now.

Once the world uses up all of the cheap, easy oil, prices will go up, and then we can use advanced technology to extract what should be the “last resort” oil – the most difficult to extract.

Perhaps by then, we’ll need it more for manufacturing (plastics, etc.) than for burning.

And maybe we’ll have a method of extraction that isn’t so environmentally devastating.

In the meantime, great strides have been made with renewables, especially solar.

There are massive opportunities in solar and battery research and production. Why not take that $3.3 billion we’re throwing away (to an unprofitable industry with few jobs) and invest it in something that might have a brighter future?

Let’s put away this silly notion of building a new pipeline to transport dirty, risky, money-losing oil, and instead diversify Canada’s energy portfolio to help absorb future economic shocks.

Oh, and in terms of the pipeline, did you know a large section of the Trans Mountain pipeline runs through residential neighbourhoods?

“Since Texas-based Kinder Morgan bought the line in 2005, there have been 13 oil spills totalling 5,628 barrels of crude. CBC even reported on some of them, including the 2007 gusher that coated houses in Burnaby’s Westridge neighbourhood before draining into Burrard Inlet.” - source

Here’s a picture of the most recent spill:

How would you feel if this pipeline was being built in your neighbourhood?